Coney Island Beach After Sandy

As I listened to the radio early this November I heard the story of a man in New Jersey whose house was flooded after the ravages of Hurricane Sandy. The man was asked about his insurance policy. He said he had a hard time getting insurance, because he lives in an area at high risk for flooding. As the interview continued, the New Jersey man said that while he eventually found an insurer, the insurance he purchased did not cover flooding because, you guessed it, he lived in a high flood area. Two thoughts went through my mind, one charitable, one logical.

Charitable first: poor guy, he just lost his house. That’s just terrible. How is he going to be able to pay for the damage if he’s not covered by insurance? And he can’t even get flood insurance when he’s trying? We need to do something about that.

Logical risk manager second (and yes, I totally used to be that guy… and no, he’ll never totally go away): C’mon man! You live in a high flood area! You knew you were going to pay if it hit the fan! This is just the cost of paying for that million-dollar ocean view you’ve enjoyed all these years.

Now, that may not be very charitable (my second response isn’t for sure), but outside of charity and logic, the conflict I saw in my own two reactions brought me back to the way we here at TJP have framed the debate on health care (see Mike Rozier’s pieces on Health Care Reform and Mandated Reporting) and the two views of society that were given during the presidential campaign (see Mario Powell’s powerful article on Individualism vs. Institutionalism). But this insurance thing? That’s an economic theory sort of business. As I said in my previous TJP article, and as I heard that November morning on the radio, the tricky part is the policy piece; it’s not the theory but the implementation.

So, in good TJP style, I want take a look at both theory and practice, and use my reactions to the superstorm Sandy disaster relief to see how America can rise above mixed partisan feelings after a bitter road to Decision 2012 .

***

As we built up to November 6, 2012 over the past two years the election-talk has been about two ways to look at the role of government in America. We could say that we are offered two poles.

The first pole I’d like to call “solidarity-participation.” People who take his perspective generally hold that the role of the government is to actively promote solidarity between citizens: the richer contribute to the welfare of the poorer; the healthier fund the care of the sick, you get the idea. I think that solidarity-participation is a good name for this pole because it’s a perspective where citizens participate in the life and well being of the whole of the country by way of solidarity with the less fortunate. I’m glossing here, but as Mario laid out the case for us (here’s that link again), that’s basically the stance of the Democratic party.

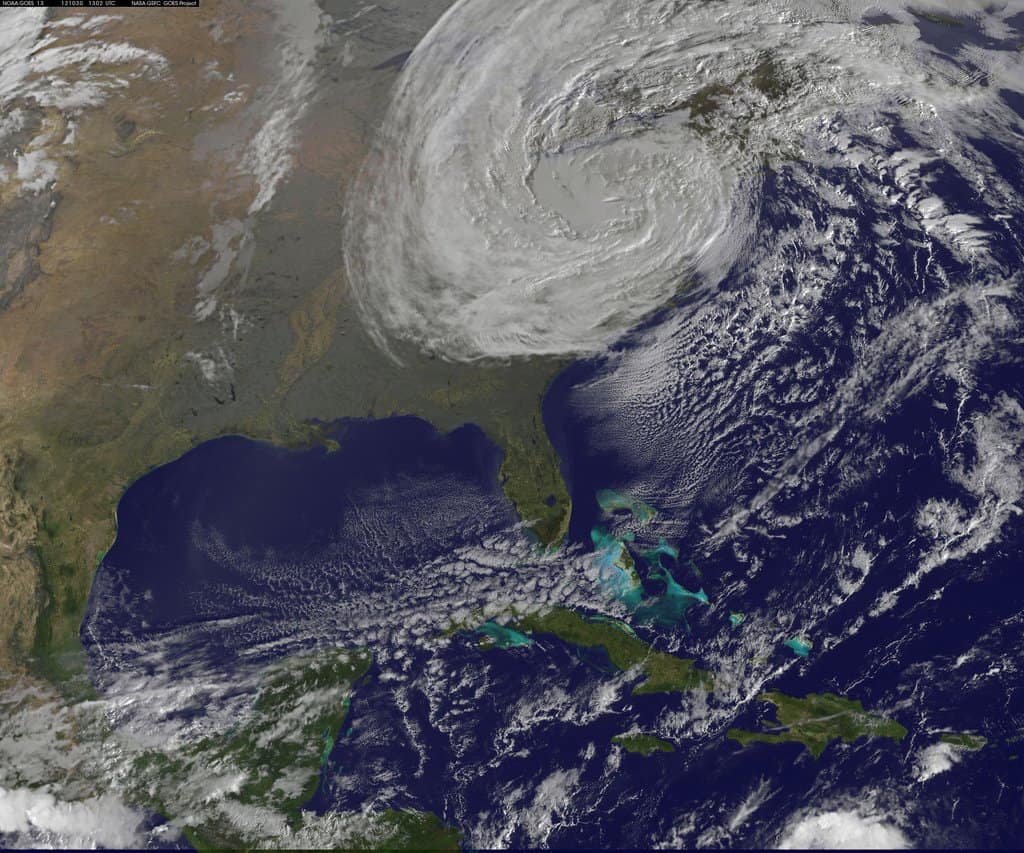

Sandy by Satellite

The basis for a solidarity-participation stance basically comes down to Elizabeth Warren’s point that people who do well are able to do well thanks to certain base-level common goods (i.e., public education, infrastructure, etc.) that are government funded (or at least commonly achieved). President Obama tried to something similar in his in/famous “you didn’t build that” sound bite.

Why did “you didn’t build that” played against Obama? Because it clashes against the other pole, what we might call “autonomy-responsibility.” People who stand under the autonomy-responsibility banner hold that, in this world, you work for what you get, earn what you deserve, and are responsible for you and yours. The government’s job is to leave people alone so they can do what they do best without interference and enjoy the fruits of their labor. This pole says that we’re each responsible for our own good and well-being. Again glossing, but we can see a lot of Republican party positions that make sense from this perspective.

Both have a point.

Roads are common goods, and we use them to get to work, so that we can make money, and etc. The only reason we get to do what we do is because we all live and strive together. It’s about community, people, relationships.

On the other hand, if too many people take communal support for granted, or only take from the community instead of also giving to it, then we risk encouraging lethargy and codependence. We risk creating situation where people are unmotivated to work hard and to be creative. If we move too far in this direction, autonomy-responsibility-ers fear, we’d lose the American way, the entrepreneurial guts of the country, the middle class.

***

One of the many beautiful things about economics is that it recognizes two things: (1) life happens and yet (2) we still have choices at key junctures. That dynamic is seldom clearer than when looking at insurance economics.

Insurance economics lies right at the collision point of our two poles. Why do people get insured? First, because there’s a risk. Second, because someone recognizes that by coming together, by pooling our risk into a collective, we can find a balance between collected premiums and payouts.1 Take auto insurance. There’s a risk that you may damage your car, or may get your car damaged by someone else. But, presumably (and depending on where you live), not every one is a bad driver. So, if I get to be an auto insurer for a particular state, collecting premiums from drivers in that state, I know that I will only have to pay some of that money out for damages and that I’ll get to keep the rest. It’s all about probabilities, but you get the point. What this comes down to is that we can rightly say that insurance is about “solidarity-participation”: pooling the risk (participation) and using that sum of money to pay for any damages (solidarity). But, this only works if we have a balanced pool. If the only people who purchase auto insurance are terrible drivers the risk-pooling system falls apart. The lesson: we need solidarity between people who more at risk and others who are less at risk.

The other pole, that of “responsibility-autonomy,” however, is also alive and well in insurance economics. This is true for two reasons. First, sometimes people who are insured become irresponsible because they know they won’t have to pay for the costs of their bad behavior (insurers call this “moral hazard,” which was also the name of a death metal band I started when I was 14… just kidding). Think of David Hasselhoff and K.I.T.T. cruising down the street when the ‘Hoff thinks: “Heck, I’ll drive against traffic at 60mph on a residential one-way street, I’m insured!”2 And even if you’re not the “primary field agent in the pilot program of [a] Knight Industries-funded public justice organization”3 Maybe you’ll start driving faster, or pull into tighter parking spots, or drive off-road in a way that may damage your car’s power train, or its windshield, all the while being confident that someone else will pay for it. If a large number of people do this, the pool of money from the premiums cannot cover the amount of damages. So, we need to make insurance subscribers responsible against moral hazard.

We also need a risk that depends on certain people, something where people are in control, where they are autonomous. I can’t get insured against death, as in “if I die you give me $1,000,000 no matter what.” Death is certain, it is not a risk you can “hedge” for or against. I can only get life-insurance under certain conditions: premiums dependent on a certain life expectancy or based on how I eat, whether I have a medical condition or how old I am. In other words, risk is conditional. But this shows us something important regarding autonomy: to insure myself against risk, I must have control over some of the parameters (e.g., how I eat), even if not all (e.g., how old I am).

So, when we talk about insurance, we talk about crossing the stream of solidarity-participation with the stream of responsibility-autonomy. And it can work (insurers are no ghost-busters!). This can work really well, if the pool of people is large enough and the probability of risk is small enough.

***

Insurance funds get overwhelmed when the pool of participants shrinks too low, or the risk and payouts suddenly becomes huge. The super storm puts us in the second kind of issues.

Think back of my New Jersey homeowner, let’s call him Joe. As he heard about the storm coming, he knew that he couldn’t move his house to Arizona where – presumably – the risk of flooding is markedly lower. And Joe can’t pay to fix the place where he lives, he just doesn’t have the money. The same goes for Joe’s neighbors. If you live in New Jersey (or New York, or… the Northeast corridor) in October 2012, the risk you face on your house is “systematic”: there’s no pooling of non-risk vs. risky. The storm will come. Your home is bound (literally!) to be on Sandy’s path. The damage will be done. No control about it, for Joe, for his neighbors, and for millions of other folks.

You could say that since Joe – and millions of others – were not insured against flood, the damages are on them. But there’s no avoiding Sandy, and it’s not even like New Jersey is a usual hurricane zone like some other geographical areas in the U.S.

We can’t fight it out simply by having the solidarity people yell at the responsibility people, and vice-versa.

What the post Hurricane Sandy insurance problem points to is that the strict “us vs. them” conversation is not really helping us solve real life problems. Even more, underscoring the division of Americans into perspectival camps of solidarity-participation vs. responsibility-autonomy is not helping much either.

And the politicians have realized it: it’s quite a surprise to see Barack Obama and Chris Christie visit New Jersey together. They finally allowed themselves to get out of their rhetoric of “you’re the bad guy” for a while. Why? Because they recognize that they need to work together for the good of the people. Yes folks, we’re talking about the common good. Because the common good demands solidarity, responsibility, autonomy, and participation. All of it. That’s what the past few days have shown us. The cool part is that politicians recognize this… at least until they go back to campaign for 2014. Already, John Boehner is telling his peeps that they need to work with President Obama on the “fiscal cliff” facing our country.

It’s been just over a month since Hurricane Sandy. Regardless of who we voted for, or whether we live in New Jersey, we need to bridge the solidarity-participation and autonomy-responsibility divide in order to move forward. That’s true for the victims of super storm Sandy, that’s also true if we want to ensure a (common) good future for America. Running a country, like running an insurance company, requires collecting some money to make life easier and more secure for all. And in both cases, sometimes the system fails, and you need to reset the vision, get into emergency problem fixing mode.

Our solidarity with the victims of Superstorm Sandy is a witness to our responsibility. Our participation to the reconstruction of the East Coast is a first step towards the recovery of autonomy for the devastated cities and their citizens. Let’s build a common good of solidarity, responsibility, autonomy, and participation.

— — — — —

- Okay, actually the goal is to make money between the difference in premiums and payouts, but the fact that we believe that might work only comes when we admit that the world is, collectively, more safe than it is dangerous: not every instance of possible risk will take place. ↩

- Please, take no advise from the ‘Hoff and don’t do this in your Oldsmobile. ↩

- Did I really just quote from the Wikipedia page on Knight Rider?! Yep. And this is why the internet is great. PS. Students reading this: do I as your teacher says, not as TJP does. ↩